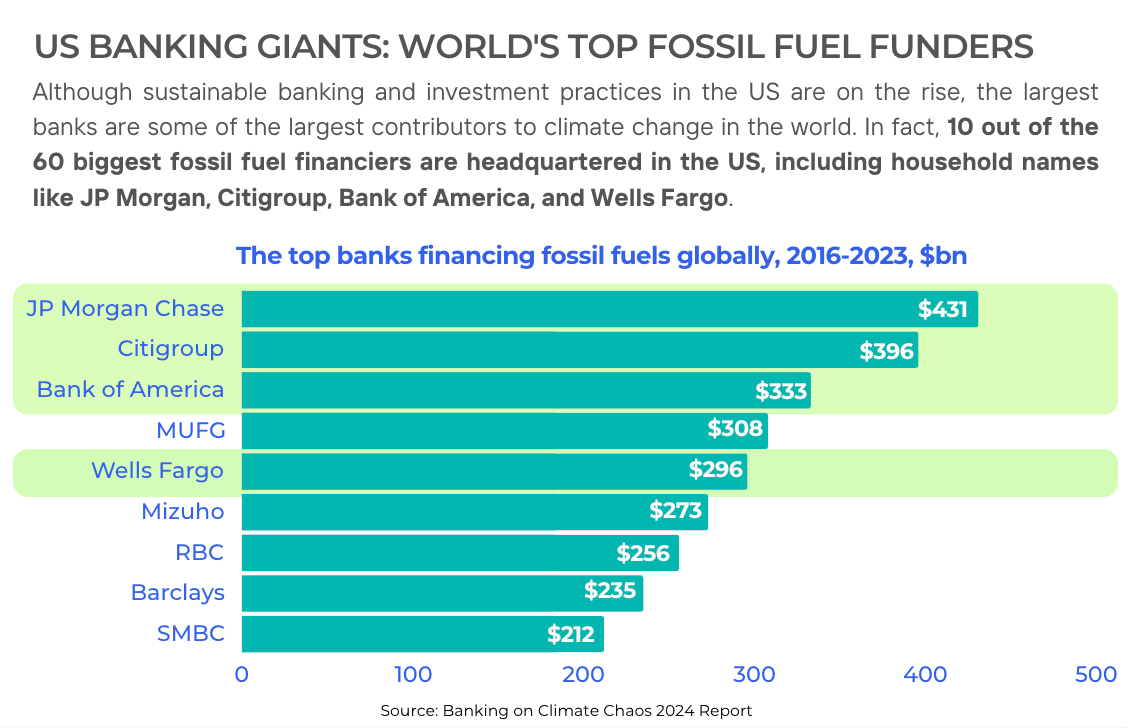

In 2023, JP Morgan Chase, Citigroup, Bank of America and Wells Fargo topped the charts as the worst financiers of fossil fuels, according to the latest Banking on Climate Chaos report.

The staggering figures reveal that between 2016 and 2023, just these four financial titans poured over $1.35 billion into companies engaged in extracting and burning fossil fuels.

Ironically, each of the four US banks have publicly committed to achieving net-zero emissions by 2050, aligning themselves with the goals set forth in the Paris Agreement. However, their actions seem to contradict these aspirations, as the banks continue to bankroll the very industries responsible for exacerbating the climate crisis. This glaring inconsistency has drawn intense criticism from environmental advocates and conscious consumers alike.

JP Morgan Chase ranked first as the top financier of fossil fuels, increasing its financing from $35.4 billion to $37 billion in 2023. The bank also topped the charts regarding fossil fuel expansion plans, with its committments rising from $17.1 billion in 2022 to $19.3 billion a year later.

JPMorgan Chase, Bank of America, Citi, and Wells Fargo all announced in early 2024 that they would leave the Equator Principles, which set minimum standards on risks to the environment and local communities in countries where they finance oil, gas, coal, infrastructure, and mining projects.

To really tackle the climate crisis and reduce its harmful effects, the financial sector needs to change its approach. Conscious consumers and investors are increasingly demanding that financial institutions align their practices with sustainable and ethical principles, potentially jeopardizing the bank's reputation and long-term profitability.

Adopting sustainable finance isn't just the right thing to do; it’s also a smart move for financial institutions. It allows them to secure their future and benefit from the growing demand for eco-friendly products and services.

Fortunately, there are already green banks in the US dedicated to supporting climate-friendly projects. These banks play a crucial role in the transition to a low-carbon economy by filling the financing gap left by traditional banks, which often prioritize short-term profits over long-term sustainability.

AskSustainable is a platform that connects users with financial institutions dedicated to sustainability, helping you invest in a better future. By choosing green banks, you not only support projects that benefit the environment but also encourage the broader financial industry to adopt more sustainable practices.

share on